Circular Flow Model- Explained

What is the Circular Flow of Money?

- Marketing, Advertising, Sales & PR

- Accounting, Taxation, and Reporting

- Professionalism & Career Development

-

Law, Transactions, & Risk Management

Government, Legal System, Administrative Law, & Constitutional Law Legal Disputes - Civil & Criminal Law Agency Law HR, Employment, Labor, & Discrimination Business Entities, Corporate Governance & Ownership Business Transactions, Antitrust, & Securities Law Real Estate, Personal, & Intellectual Property Commercial Law: Contract, Payments, Security Interests, & Bankruptcy Consumer Protection Insurance & Risk Management Immigration Law Environmental Protection Law Inheritance, Estates, and Trusts

- Business Management & Operations

- Economics, Finance, & Analytics

What is the Circular Flow Model?

A good model to start with in economics is the circular flow diagram. It pictures the economy as consisting of two groups—households and firms—that interact in two markets: the goods and services market in which firms sell and households buy and the labor market in which households sell labor to business firms or other employees.

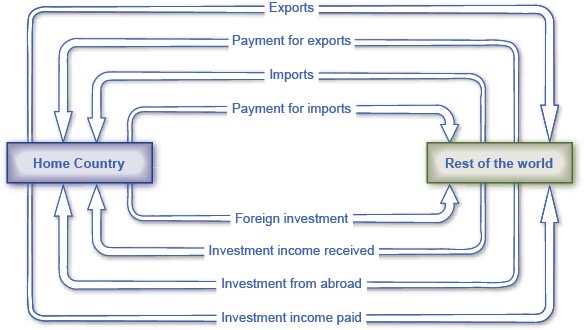

Flow of Investment Goods and Capital Each element of the current account balance involves a flow of financial payments between countries. The top line shows exports of goods and services leaving the home country; the second line shows the money that the home country receives for those exports. The third line shows imports that the home country receives; the fourth line shows the payments that the home country sent abroad in exchange for these imports.

The circular flow diagram shows how households and firms interact in the goods and services market, and in the labor market. The direction of the arrows shows that in the goods and services market, households receive goods and services and pay firms for them. In the labor market, households provide labor and receive payment from firms through wages, salaries, and benefits.

Firms produce and sell goods and services to households in the market for goods and services (or product market). Arrow “A” indicates this. Households pay for goods and services, which becomes the revenues to firms. Arrow “B” indicates this. Arrows A and B represent the two sides of the product market. Where do households obtain the income to buy goods and services? They provide the labor and other resources (e.g. land, capital, raw materials) firms need to produce goods and services in the market for inputs (or factors of production). Arrow “C” indicates this. In return, firms pay for the inputs (or resources) they use in the form of wages and other factor payments. Arrow “D” indicates this. Arrows “C” and “D” represent the two sides of the factor market.

Of course, in the real world, there are many different markets for goods and services and markets for many different types of labor. The circular flow diagram simplifies this to make the picture easier to grasp. In the diagram, firms produce goods and services, which they sell to households in return for revenues. The outer circle shows this, and represents the two sides of the product market (for example, the market for goods and services) in which households demand and firms supply. Households sell their labor as workers to firms in return for wages, salaries, and benefits. The inner circle shows this and represents the two sides of the labor market in which households supply and firms demand.

This version of the circular flow model is stripped down to the essentials, but it has enough features to explain how the product and labor markets work in the economy. We could easily add details to this basic model if we wanted to introduce more real-world elements, like financial markets, governments, and interactions with the rest of the globe (imports and exports).

Economists carry a set of theories in their heads like a carpenter carries around a toolkit. When they see an economic issue or problem, they go through the theories they know to see if they can find one that fits. Then they use the theory to derive insights about the issue or problem. Economists express theories as diagrams, graphs, or even as mathematical equations. (Do not worry. In this course, we will mostly use graphs.) Economists do not figure out the answer to the problem first and then draw the graph to illustrate. Rather, they use the graph of the theory to help them figure out the answer. Although at the introductory level, you can sometimes figure out the right answer without applying a model, if you keep studying economics, before too long you will run into issues and problems that you will need to graph to solve. We explain both micro and macroeconomics in terms of theories and models. The most well-known theories are probably those of supply and demand, but you will learn a number of others.

Related Topics

- Legal Tender

- Numismatics

- Gresham's Law

- Barter

- Double Coincidence of Wants

- Parity

- Functions of Money

- Medium of Exchange

- Unit of Account

- Store of Value

- Time Value of Money

- Standard of Deferred Payment

- Liquidity Preference Theory

- National Savings and Investment Identity

- Circular Flow of Money

- Commodity Money

- Gold Exchange Standard

- Bretton Woods System

- Fiat Money

- Money Supply

- M1 and M2 Money Supply

- Monetary Base

- Savings, Demand, and Time Deposits

- Banks

- How Do Banks Create Money?

- Financial Intermediary

- Bank Balance Sheet

- Money Multiplier Formula

- Velocity of Money

- Multiplier Effect

- Quantity Equation of Money

- McCallum Rule

- Neutrality of Money

- Real Bills Theory

- Banking System?

- Central Bank

- Federal Reserve System

- Federal Open Market Committee (FOMC)

- Fed Balance Sheet

- Term Auction Facility

- Taylor Rule

- How is the Federal Reserve Bank Organized?

- What is Bank Regulation?

- CAMELS Rating

- FDIC

- CFPB

- Bank Supervision

- Bank Runs

- What is Deposit Insurance?

- Federal Deposit Insurance Corporation

- Lender of Last Resort

- Central Banks Carry Out Monetary Policy

- Open Market Operations

- Bank Reserve

- Discount Rate

- Federal Funds Rate

- Monetary Policy

- Contractionary and Expansionary Monetary Policy

- Loose vs Tight Monetary Policy

- Easy Monetary Policy

- Accommodative Monetary Policy

- Dove & Hawk (Monetary Policy) - Explained

- Tight Monetary Policy - Explained

- Stabilization Policy

- Pushing on a String

- The Effect of Monetary Policy on Interest Rates

- Federal Funds Rate

- Gibson Paradox

- Vasicek Interest Rate Model

- Equation of Exchange (Economics)

- The Effect of Monetary Policy on Aggregate Demand

- Quantitative Easing

- Reserve Currency

- What are Excess Reserves?

- Unpredictable Movements of Velocity

- Central Banks - Unemployment and Inflation

- Inflation Targeting

- Fisher Effect

- Asset Bubbles and Leverage Cycles

- Countercyclical

- Money Capital Market

- Quantity Theory of Money

- Aggregate Expenditure Model

- IS-LM Model

- European Capital Market Institute