What is a Financial Intermediary?

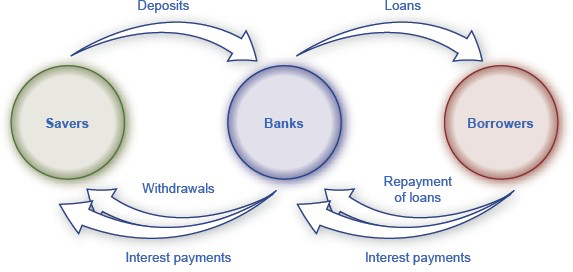

An “intermediary” is one who stands between two other parties. Banks are a financial intermediary—that is, an institution that operates between a saver who deposits money in a bank and a borrower who receives a loan from that bank. Financial intermediaries include other institutions in the financial market such as insurance companies and pension funds, but we will not include them in this discussion because they are not depository institutions, which are institutions that accept money deposits and then use these to make loans. All the deposited funds mingle in one big pool, which the financial institution then lends. The below figure illustrates the position of banks as financial intermediaries, with deposits flowing into a bank and loans flowing out. Of course, when banks make loans to firms, the banks will try to funnel financial capital to healthy businesses that have good prospects for repaying the loans, not to firms that are suffering losses and may be unable to repay.

Banks act as financial intermediaries because they stand between savers and borrowers. Savers place deposits with banks, and then receive interest payments and withdraw money. Borrowers receive loans from banks and repay the loans with interest. In turn, banks return money to savers in the form of withdrawals, which also include interest payments from banks to savers.