How are Short-Run Decisions Based Upon Costs made in a Perfectly Competitive Market?

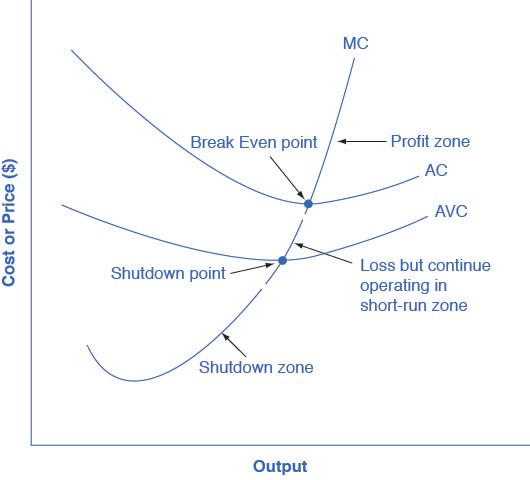

The average cost and average variable cost curves divide the marginal cost curve into three segments.

At the market price, which the perfectly competitive firm accepts as given, the profit-maximizing firm chooses the output level where price or marginal revenue, which are the same thing for a perfectly competitive firm, is equal to marginal cost: P = MR = MC.

We can divide marginal cost curve into three zones, based on where it is crossed by the average cost and average variable cost curves.

We call the point where MC crosses AC the break even point. If the firm is operating where the market price is at a level higher than the break even point, then price will be greater than average cost and the firm is earning profits. If the price is exactly at the break even point, then the firm is making zero profits.

If price falls in the zone between the shutdown point and the break even point, then the firm is making losses but will continue to operate in the short run, since it is covering its variable costs, and more if price is above the shutdown-point price.

However, if price falls below the price at the shutdown point, then the firm will shut down immediately, since it is not even covering its variable costs.