What is a SPACE Analysis?

Space analysis is an approach to strategic analysis used to develop a business strategy. SPACE is an acronym that stands for Strategic Position and Action Evaluation. The process for carrying out a SPACE Analysis is outlined below.

A SPACE analysis involves both an internal and external analysis.

External Analysis

The external environment is evaluated based upon:

-

Environmental Stability (ES) – Stability includes such factors as:

- technological change,

- inflation rate,

- demand volatility,

- price range of competitive products,

- price elasticity of demand, and

- pressure from the substitutes

-

Industry Attractiveness (IA) – Industry Attractiveness includes the following factors:

- growth potential,

- profit potential,

- financial stability,

- resource utilization,

- complexity of entering the industry,

- labor productivity,

- capacity utilization,

- bargaining power of manufacturers

Internal Analysis

The internal environment is evaluated based upon:

- Competitive Advantage (CA) – Competitive advantage includes the following factors:

- Market Share

- Product Quality

- Product Lifecycle

- Innovation Cycle

- Customer Loyalty

- Vertical Integration

- Financial Strength (FS) – Financial Strength includes the following factors:

- Return on investment,

- Liquidity,

- Debt ratio,

- Available versus required capital,

- Cash flow,

- Inventory turnover

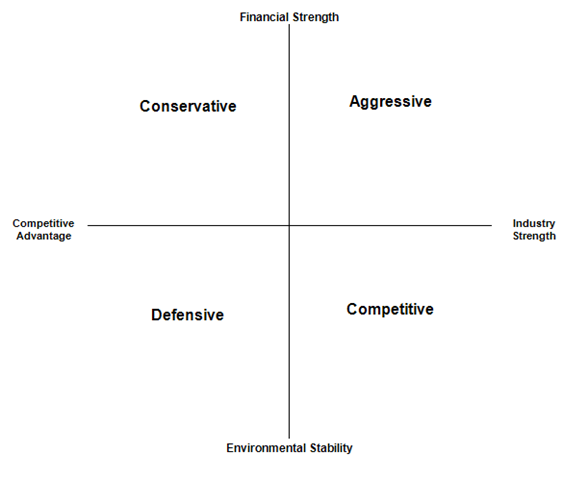

Each of these factors are assigned a value of 0-6 (or 0 through -6 for CA and ES). The average of these factor scores constitutes the value of the category. These values are plotted on a matrix with four quadrants.

This image depicts SPACE Analysis in strategic management.

Each of the respective quadrants represents a strategic business behavior. The strategic behaviors are as follows:

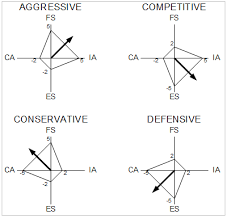

- Aggressive position – Generally, this position is for a company in a stable industry within a protectable competitive advantage. Though new entrants into the market by competitors is a threat. Strategic objectives might include mergers or acquisitions, growing market share, or diversifying products/services.

- Competitive position – Generally, this position is for a financially stable company in an unstable environment. The company has some level of competitive advantage. There is generally opportunity in business combinations/partnerships, efficiency improvement, and a stronger cash flow.

- Conservative position – Generally, this position is for a highly stable company in a stable industry. Generally, the company has a strong market share and competitive position, but a low growth rate. There is opportunity through focusing on successful products and new product development.

- Defensive position – Generally, this position is for a company in a competitive industry that lacks a strong competitive advantage. The company must generally compete on efficiency and other cost-reduction methods. Though it should strongly consider pivoting or leaving the industry.

Related Topics

- How Strategies Arise

- Intended, Deliberate, Realized, and Emergent Strategies

- Management and Strategic Planning

- Mintzberg’s Schools of Strategic Development

- Design School

- Planning School

- Positioning School

- Entrepreneurial School

- Cognitive School

- Learning School

- Power School

- Culture School

- Environmental School

- Configuration School

- Mintzberg’s 5Ps of Strategy

- McKinseys 7s Model

- ***Industry Analysis to Build a Strategy***

- Strategic Analysis

- SWOT Analysis

- SPACE Analysis

- Situational Analysis – 7C

- Competition Profile Matrix

- Stakeholder Analysis

- Stakeholder Mapping

- Resources and Capabilities

- VMOST

- Core Competency

- VRIO Analysis

- Value Chain Analysis

- Internal Factor Analysis

- Value Creation Index

- Minimum Efficient Scale

- PEST(LE) Analysis

- Industry Lifecycle Analysis

- Company Lifecycle – Definition

- Porter’s Five Forces

- Modes of Management

- External Factor Evaluation

- Strategy Implementation

- Eclectic Implementation Model

- Mintzberg’s Modes of Strategic Decision-Making

- Mintzberg’s Five Configurations

- Value Engineering

- Business Performance Measurement

- Benchmarking

- Balanced Scorecard

- Economic Value Added

- Activity-Based Management

- Quality Management

- Action Profit Linkage Model

- Business Activity Monitoring

- Gap Analysis

- Strategy Diamond

- BCG Growth-Share Matrix

- GE McKinsey Matrix

- Value Reporting Framework

- Pyrrhic Victory