What is a Discounted Cash Flow?

Discounted cash flow (DCF) is one of the most important methods used for evaluating the value of a company, project or asset based on future cash flows. It estimates the value of all future cash flows and then discounts them to find a present value. This present value is used for assessing the value of a potential investment. Usually, if the value is greater than the cost of the investment then it is worth considering.

How Does Discounted Cash Flow Work?

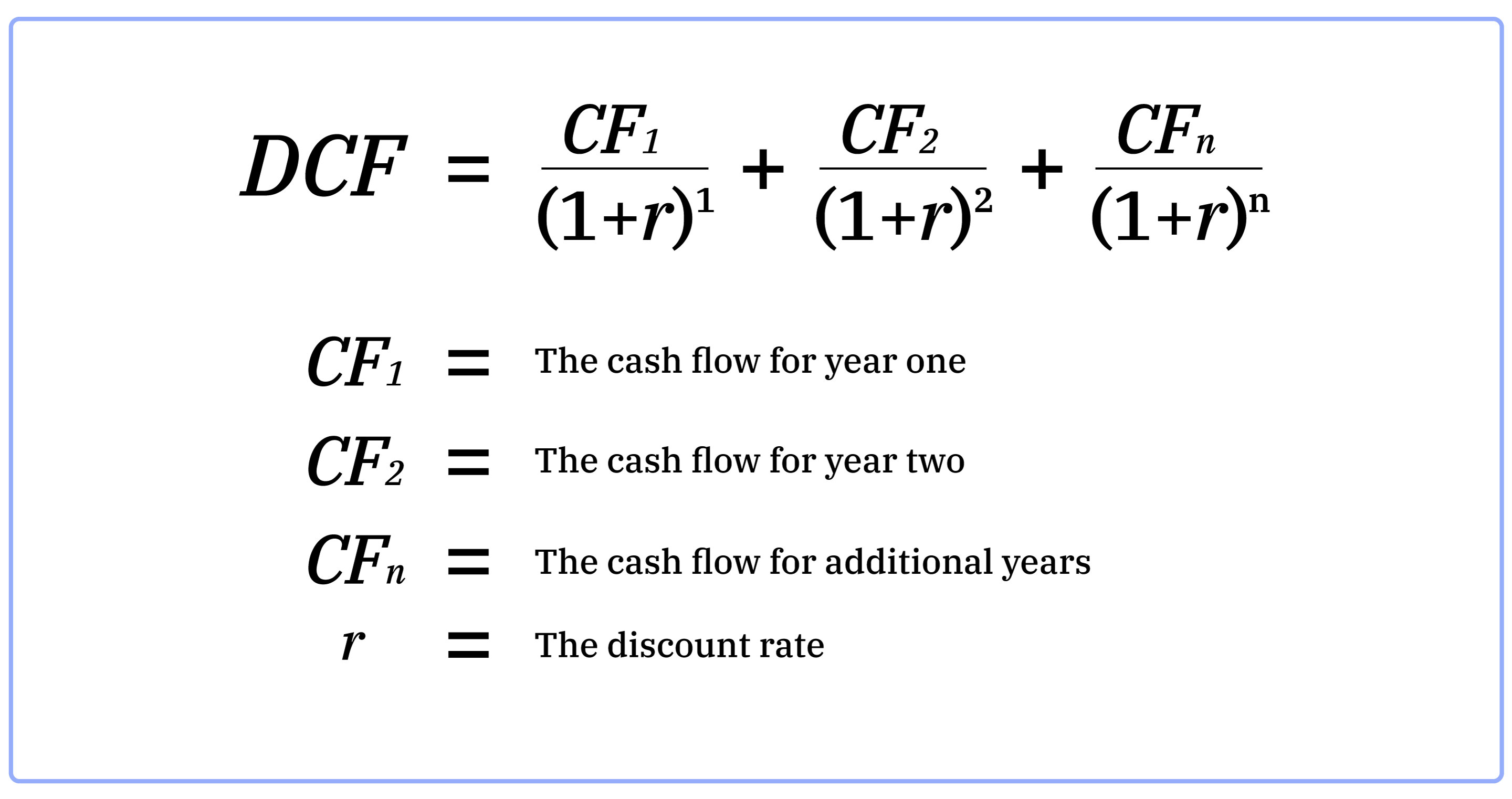

The method followed in calculating DCF is

CF = Cash Flow

r = discount rate (WACC)

DCF is also called the Discounted Cash Flows Model.

DCF analysis is widely used in finance including investment finance, real estate development, corporate finance, and others. It evaluates how much money an investor would get from an investment. The estimate is adjusted for the time value of money. According to the time value of money, a dollar is more valuable today than tomorrow. It becomes difficult to use the DCF method in cases of large and complicated investment. Selecting the cash flow to be discounted is a challenge in such cases. Also, if the investor does not have access to the future cash flow, this method cannot be applied. When using this method for business purchases, the new owners can evaluate the firm with the estimated future cash flow. DCF is far more useful for evaluating individual investments or projects. It enables the firm and the individual to predict confidently. Regardless of the purpose, the discount cash flow method assumes a discount rate. There are different methods to calculate the correct discount rate. It can be a simple percentage or a value calculated by Weighted Average Cost of Capital (WACC).