What is Perceived Demand for a Monopolistic Competitor?

A monopolistically competitive firm perceives a demand for its goods that is an intermediate case between monopoly and competition.

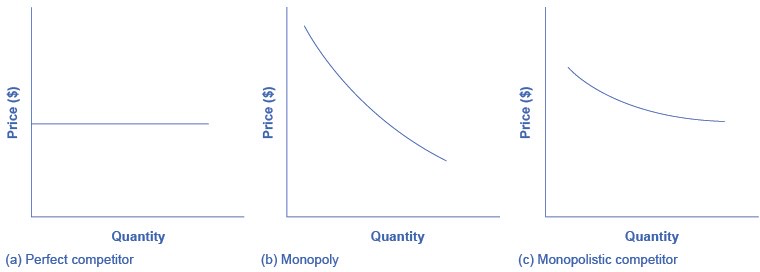

The demand curve that a perfectly competitive firm faces is perfectly elastic or flat, because the perfectly competitive firm can sell any quantity it wishes at the prevailing market price. In contrast, the demand curve, as faced by a monopolist, is the market demand curve, since a monopolist is the only firm in the market, and hence is downward sloping.

The demand curve that a perfectly competitive firm faces is perfectly elastic, meaning it can sell all the output it wishes at the prevailing market price. The demand curve that a monopoly faces is the market demand. It can sell more output only by decreasing the price it charges. The demand curve that a monopolistically competitive firm faces falls in between.

The demand curve as a monopolistic competitor faces is not flat, but rather downward-sloping, which means that the monopolistic competitor can raise its price without losing all of its customers or lower the price and gain more customers. Since there are substitutes, the demand curve facing a monopolistically competitive firm is more elastic than that of a monopoly where there are no close substitutes. If a monopolist raises its price, some consumers will choose not to purchase its product—but they will then need to buy a completely different product. However, when a monopolistic competitor raises its price, some consumers will choose not to purchase the product at all, but others will choose to buy a similar product from another firm. If a monopolistic competitor raises its price, it will not lose as many customers as would a perfectly competitive firm, but it will lose more customers than would a monopoly that raised its prices.

At a glance, the demand curves that a monopoly and a monopolistic competitor face look similar—that is, they both slope down. However, the underlying economic meaning of these perceived demand curves is different, because a monopolist faces the market demand curve and a monopolistic competitor does not. Rather, a monopolistically competitive firm’s demand curve is but one of many firms that make up the “before” market demand curve.