How does New Technology give rise to Positive Externalities?

Will private firms in a market economy underinvest in research and technology? If a firm builds a factory or buys a piece of equipment, the firm receives all the economic benefits that result from the investments. However, when a firm invests in new technology, the private benefits, or profits, that the firm receives are only a portion of the overall social benefits.

The social benefits of an innovation account for the value of all the positive externalities of the new idea or product, whether enjoyed by other companies or society as a whole, as well as the private benefits the firm that developed the new technology receives.

Positive externalities are beneficial spillovers to a third party, or parties.

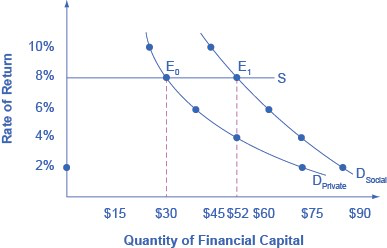

The downward-sloping DPrivate curve represents the firm’s demand for financial capital and reflects the company’s willingness to borrow to finance research and development projects at various interest rates.

Suppose that this firm’s investment in research and development creates a spillover benefit to other firms and households. After all, new innovations often spark other creative endeavors that society also values. If we add the spillover benefits society enjoys to the firm’s private demand for financial capital, we can draw DSocial that lies above DPrivate.

If there were a way for the firm to fully monopolize those social benefits by somehow making them unavailable to the rest of us, the firm’s private demand curve would be the same as society’s demand curve.

Unless there is a way for the company to fully enjoy the total benefits, then it will borrow less than the socially optimal level.

The firm’s original demand for financial capital (DPrivate) is based on the profits received the firm receives. However, other companies may learn new lessons and then able to create their own competing products. The social benefit of the product takes into account the value of all the product’s positive externalities.

If the company were able to gain this social return instead of other companies, its demand for financial capital would shift to the demand curve DSocial, and it would be willing to borrow and invest $52 million.

However, if Big Drug is receiving only 50 cents of each dollar of social benefits, the firm will not spend as much on creating new products. The amount it would be willing to spend would fall somewhere in between DPrivate and DSocial.

Related Topics

- Market Competition and Innovation

- New Technology and Positive Externalities

- Externality

- Network Externality

- Pigovian Tax

- Coase Theorem

- Agglomeration Diseconomies

- Education – Private and Social Rate of Return

- Government Approaches to Encouraging Innovation

- Public Good

- Public, Private, Club, Common Goods

- Excludable and Rivalrous Goods

- What is the Free Rider Problem for Public Goods?

- Free Rider

- Social Loafing

- Role of Government in Paying for Public Goods

- What is the Tragedy of Commons for Common Resources?

- Income Inequality

- Poverty Line?

- Poverty Trap

- Public Safety Net

- Measuring Income Inequality

- Lorenz Curve

- Ladder of Opportunity

- Tradeoff between Incentives and Income Equality