What is the Neoclassical View of Unemployment?

Economists divide unemployment into two categories: cyclical unemployment and the natural rate of unemployment, which is the sum of frictional and structural unemployment. Cyclical unemployment results from fluctuations in the business cycle and is created when the economy is producing below potential GDP—giving potential employers less incentive to hire.

When the economy is producing at potential GDP, cyclical unemployment will be zero. Because of labor market dynamics, in which people are always entering or exiting the labor force, the unemployment rate never falls to 0%, not even when the economy is producing at or even slightly above potential GDP. Probably the best we can hope for is for the number of job vacancies to equal the number of job seekers. We know that it takes time for job seekers and employers to find each other, and this time is the cause of frictional unemployment. Most economists do not consider frictional unemployment to be a “bad” thing. After all, there will always be workers who are unemployed while looking for a job that is a better match for their skills. There will always be employers that have an open position, while looking for a worker that is a better match for the job. Ideally, these matches happen quickly, but even when the economy is very strong there will be some natural unemployment and this is what the natural rate of unemployment measures.

The neoclassical view of unemployment tends to focus attention away from the cyclical unemployment problem—that is, unemployment caused by recession—while putting more attention on the unemployment rate issue that prevails even when the economy is operating at potential GDP. To put it another way, the neoclassical view of unemployment tends to focus on how the government can adjust public policy to reduce the natural rate of unemployment. Such policy changes might involve redesigning unemployment and welfare programs so that the support those in need, but also offer greater encouragement for job-hunting. It might involve redesigning business rules with an eye to whether they are unintentionally discouraging businesses from taking on new employees. It might involve building institutions to improve the flow of information about jobs and the mobility of workers, to help bring workers and employers together more quickly. For those workers who find that their skills are permanently no longer in demand (for example, the structurally unemployed), economists can design policy to provide opportunities for retraining so that these workers can reenter the labor force and seek employment.

Neoclassical economists will not tend to see aggregate demand as a useful tool for reducing unemployment; after all, with a vertical aggregate supply curve determining economic output, then aggregate demand has no long-run effect on unemployment. Instead, neoclassical economists believe that aggregate demand should be allowed to expand only to match the gradual shifts of aggregate supply to the right—keeping the price level much the same and inflationary pressures low.

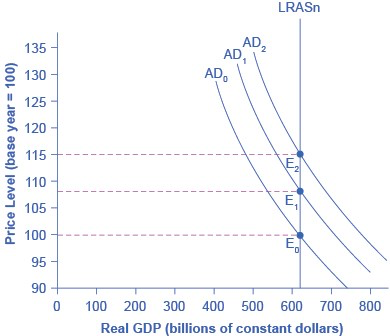

If aggregate demand rises rapidly in the neoclassical model, in the long run it leads only to inflationary pressures. The figure shows a vertical LRAS curve and three different levels of aggregate demand, rising from AD0 to AD1 to AD2. As the macroeconomic equilibrium rises from E0 to E1 to E2, the price level rises, but real GDP does not budge; nor does the rate of unemployment, which adjusts to its natural rate. Conversely, reducing inflation has no long-term costs, either. Think about this situation in reverse, as the aggregate demand curve shifts from AD2 to AD1 to AD0, and the equilibrium moves from E2 to E1 to E0. During this process, the price level falls, but, in the long run, neither real GDP nor the natural unemployment rate changes.

As aggregate demand shifts to the right, from AD0 to AD1 to AD2, real GDP in this economy and the level of unemployment do not change.

However, there is inflationary pressure for a higher price level as the equilibrium changes from E0 to E1 to E2.