Value of Dividends Method - Explained

What is the Value of Dividends Method of Valuation?

- Marketing, Advertising, Sales & PR

- Accounting, Taxation, and Reporting

- Professionalism & Career Development

-

Law, Transactions, & Risk Management

Government, Legal System, Administrative Law, & Constitutional Law Legal Disputes - Civil & Criminal Law Agency Law HR, Employment, Labor, & Discrimination Business Entities, Corporate Governance & Ownership Business Transactions, Antitrust, & Securities Law Real Estate, Personal, & Intellectual Property Commercial Law: Contract, Payments, Security Interests, & Bankruptcy Consumer Protection Insurance & Risk Management Immigration Law Environmental Protection Law Inheritance, Estates, and Trusts

- Business Management & Operations

- Economics, Finance, & Analytics

What is the Value of Dividends Method of Valuation?

This method relies on the idea that a stock is only worth what it will provide to investors in future dividends. If a business does not currently distribute dividends, the value of the stock will appreciate under apprehension of future dividend distributions. As such, the firm can be valued by discounting future cash flows (dividends) to shareholders.

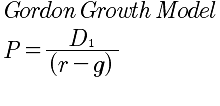

The appropriate discount rate may be determined by any method. Here is a formula for this valuation method: Where: P= the price at time 0 r= discount rate This formula is the basic equivalent of the formula for bringing a perpetual cash flow back to present value. This method is often modified to project the present value of the dividends given a constant, perpetual growth rate for the dividends. This is known as the constant growth DDM or the Gordon model for discounting future cash flows.

The formula is as follows:

Issues with Value of Dividends

Like the EVA approach, the dividend discount model requires the individual valuing the business to speculate as to the future dividends of the business. Some DDM models assume that a business dividends grow at a constant rate.

Other models attempt to identify variable dividends based upon the growth stages of the business. These forms of valuations involve complex models that must also rely on assumptions about uncertain cash flows.

Lastly, the required rate of return to use to discount future dividends is speculative. If a company is high-growth, a valuation based upon the company meeting an expected rate of return will undervalue the company. Further, if the company fails to pay a dividend at a given point, it affects the valuation from that point forward.