How do Expectations about Future Exchange Rates Shift Demand?

One reason to demand a currency on the foreign exchange market is the belief that the currency’s value is about to increase. One reason to supply a currency—that is, sell it on the foreign exchange market—is the expectation that the currency’s value is about to decline. For example, imagine that a leading business newspaper, like the Wall Street Journal or the Financial Times, runs an article predicting that the Mexican peso will appreciate in value.

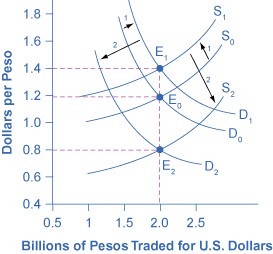

Demand for the Mexican peso shifts to the right, from D0 to D1, as investors become eager to purchase pesos. Conversely, the supply of pesos shifts to the left, from S0 to S1, because investors will be less willing to give them up. The result is that the equilibrium exchange rate rises from 10 cents/peso to 12 cents/peso and the equilibrium exchange rate rises from 85 billion to 90 billion pesos as the equilibrium moves from E0 to E1.

An announcement that the peso exchange rate is likely to strengthen in the future will lead to greater demand for the peso in the present from investors who wish to benefit from the appreciation. Similarly, it will make investors less likely to supply pesos to the foreign exchange market. Both the shift of demand to the right and the shift of supply to the left cause an immediate appreciation in the exchange rate.

The figure also illustrates some peculiar traits of supply and demand diagrams in the foreign exchange market. In contrast to all the other cases of supply and demand you have considered, in the foreign exchange market, supply and demand typically both move at the same time. Groups of participants in the foreign exchange market like firms and investors include some who are buyers and some who are sellers. An expectation of a future shift in the exchange rate affects both buyers and sellers—that is, it affects both demand and supply for a currency.

The shifts in demand and supply curves both cause the exchange rate to shift in the same direction. In this example, they both make the peso exchange rate stronger. However, the shifts in demand and supply work in opposing directions on the quantity traded. In this example, the rising demand for pesos is causing the quantity to rise while the falling supply of pesos is causing quantity to fall. In this specific example, the result is a higher quantity. However, in other cases, the result could be that quantity remains unchanged or declines.

This example also helps to explain why exchange rates often move quite substantially in a short period of a few weeks or months. When investors expect a country’s currency to strengthen in the future, they buy the currency and cause it to appreciate immediately. The currency’s appreciation can lead other investors to believe that future appreciation is likely—and thus lead to even further appreciation. Similarly, a fear that a currency might weaken quickly leads to an actual weakening of the currency, which often reinforces the belief that the currency will weaken further. Thus, beliefs about the future path of exchange rates can be self-reinforcing, at least for a time, and a large share of the trading in foreign exchange markets involves dealers trying to outguess each other on what direction exchange rates will move next.

Related Topics

- What Does it Mean to Dollarize

- Foreign Exchange Market

- Who Demands and Supplies Currency in a Foreign Exchange Market?

- Foreign Direct Investment

- Greenfield Investment

- Brownfield Investment

- Portfolio Investment

- Hedging

- Dealers in the Interbank Market

- Weak and Strong Currency

- Depreciation of Currency

- Appreciating and Depreciating Currency

- Exchange Rate

- Real Effective Exchange Rate (REER)

- Limited Flexibility Exchange Rate System

- Expectations about Future Exchange Rates Shift Demand

- Expected rate of return shift demand and supply for a currency

- Relative Inflation Shifts Demand and Supply for a Currency

- Purchasing Power Parity (PPP)

- Relative Purchasing Power Parity

- Law of One Price

- Burgernomics

- Balassa-Samuelson Effect

- Arbitrage

- Tobin Tax

- Foreign Exchange Market

- Foreign Exchange Contract

- Arbitrage

- Hedge

- Why Central Banks Care About Exchange Rates

- How Do Exchange Rates Affect Aggregate Demand and Aggregate Supply?

- What Causes Exchange Rate Fluctuations?

- Exchange Rate Policy

- Fixed Exchange Rate

- Floating Exchange Rate

- Hard and Soft Peg

- What is a Merged Currency?

- Capital Control

- Exchange Stabilization Fund