What is the Balance of Trade as a Balance of Payments?

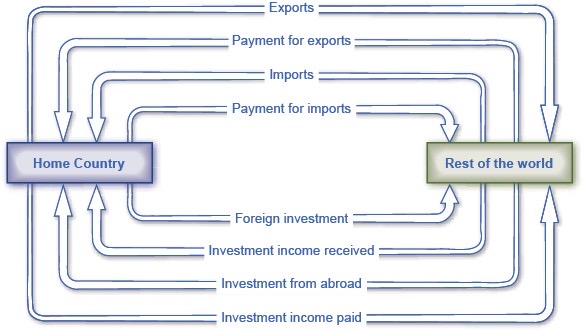

The connection between trade balances and international flows of financial capital is so close that economists sometimes describe the balance of trade as the balance of payments. Each category of the current account balance involves a corresponding flow of payments between a given country and the rest of the world economy.

The figure below shows the flow of goods and services and payments between one country—the United States in this example—and the rest of the world. The top line shows U.S. exports of goods and services, while the second line shows financial payments from purchasers in other countries back to the U.S. economy. The third line then shows

U.S. imports of goods, services, and investment, and the fourth line shows payments from the home economy to the rest of the world. Flow of goods and services (lines one and three) show up in the current account, while we find flow of funds (lines two and four) in the financial account.

The bottom four lines show the flows of investment income. In the first of the bottom lines, we see investments made abroad with funds flowing from the home country to the rest of the world. Investment income stemming from an investment abroad then runs in the other direction from the rest of the world to the home country. Similarly, we see on the bottom third line, an investment from the rest of the world into the home country and investment income (bottom fourth line) flowing from the home country to the rest of the world. We find the investment income (bottom lines two and four) in the current account, while investment to the rest of the world or into the home country (lines one and three) is in the financial account. This figure does not show unilateral transfers, the fourth item in the current account.

Flow of Investment Goods and Capital

Each element of the current account balance involves a flow of financial payments between countries. The top line shows exports of goods and services leaving the home country; the second line shows the money that the home country receives for those exports. The third line shows imports that the home country receives; the fourth line shows the payments that the home country sent abroad in exchange for these imports.

A current account deficit means that, the country is a net borrower from abroad. Conversely, a positive current account balance means a country is a net lender to the rest of the world. Just like the parable of Robinson and Friday, the lesson is that a trade surplus means an overall outflow of financial investment capital, as domestic investors put their funds abroad, while a deficit in the current account balance is exactly equal to the overall or net inflow of foreign investment capital from abroad.

It is important to recognize that an inflow and outflow of foreign capital does not necessarily refer to a debt that governments owe to other governments, although government debt may be part of the picture. Instead, these international flows of financial capital refer to all of the ways in which private investors in one country may invest in another country—by buying real estate, companies, and financial investments like stocks and bonds.